Expert Mortgage Solutions & Property Market Guidance.

Specializing in helping younger audiences navigate and overcome the challenges of buying their first property. Our personalized guidance and proven strategies empower clients to achieve financial independence and property ownership.

Backed by Mortgage Alliance

Kevin Hoang, Mortgage Agent Level 1 (#10530)

Mortgage Alliance Brokerage, Corporate Office:

1410-5140 Yonge St Street, Toronto, ON, M2N 6L7

Why Choose Kevin?

Consults and advises on unique, customizable and viable financing solutions for each client

Engages in property market analytics and research for his clients

Solid expertise in investment properties analysis while managing risk

Provides comprehensive support from mortgage pre-approval to fully tenanting property and self property management

Strong experience in development and converting properties into multifamily residences

Coaches through a methodical approach to building long-term wealth through real estate

Consults and advises on unique, customizable and viable financing solutions for each client

Engages in property market analytics and research for his clients

Solid expertise in investment properties analysis while managing risk

Provides comprehensive support from mortgage pre-approval to fully tenanting property and self property management

Strong experience in development and converting properties into multifamily residences

Coaches through a methodical approach to building long-term wealth through real estate

About Kevin

Kevin is a Certified Credit Professional (CCP). He is an expert in the field of credit and risk management. This professional background has led him to overcome many obstacles and achieve success as a Mortgage Agent, Real Estate Investor and Developer.

Kevin specializes in guiding first-time home buyers and investors, particularly young professionals. Recognizing the challenges faced by younger generations in today’s economic climate, Kevin has developed a unique approach to help clients overcome the barrier to becoming a homeowner.

“I’ve been there myself, priced out and feeling defeated. I never thought I’d get to buy a house, when I got into the market I realized this is not something I want to keep to myself. I dedicate myself to helping others get started and have outcomes better than mine.”

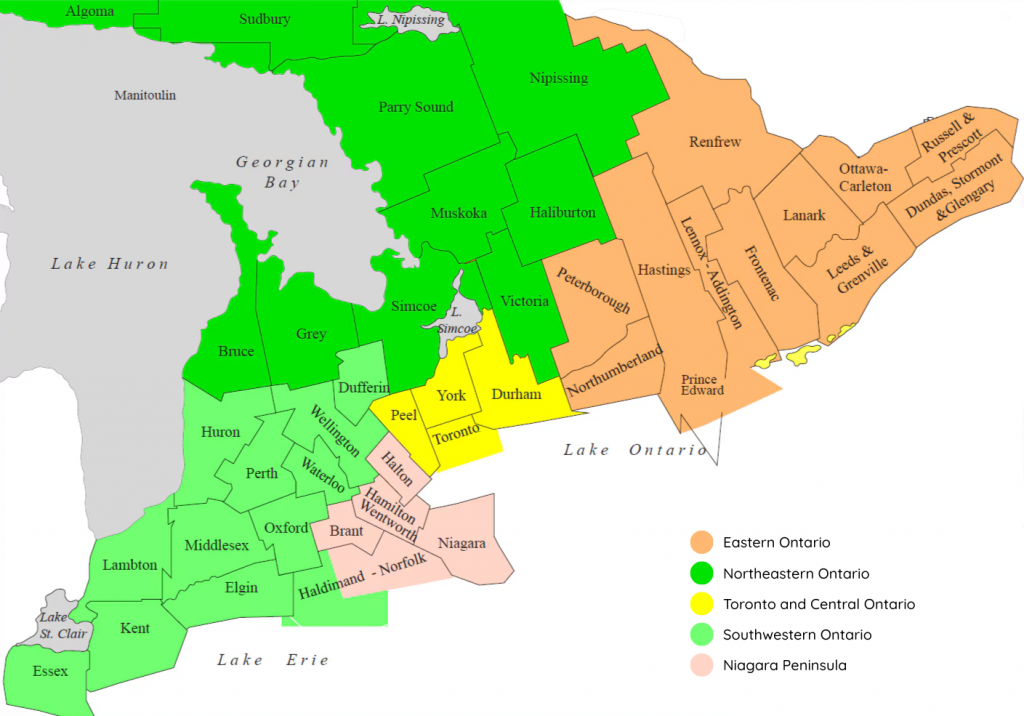

He focuses on assisting them in acquiring investment properties in overlooked, undervalued and emerging Ontario markets such as Sudbury, Hamilton, London, Chatham, Windsor, Sarnia, Region of Niagara, North Bay and many more. This strategic approach allows his clients to take advantage of opportunities to build equity and gain valuable real estate experience. Ultimately this positions them to purchase their EVENTUAL dream home and achieve financial independence through real estate investment.

Kevin invests in capital markets and owns real estate properties in Canada and the United States.

With his expertise in both mortgages and property investment, Kevin provides a DIY package through educating and coaching for young professionals looking to take their first steps into the world of real estate.

Looking for diamonds in the rough, looking for alternative solutions and going against the grain.

Home ownership isn’t out of reach, it’s waiting right in front of you. Let’s snatch it together.

How Kevin Works With You

Our simple 4-step process makes financing stress-free and understandable.

1 | Choose your service

2 | Have a FREE Discovery call with Kevin so he understands your needs

3 | Enjoy weekly calls with Kevin to get educated, be prepared and strategize

Services*

A full suite of mortgage services designed to simplify the home-buying process and empower clients to make informed decisions:

Residential Mortgage Services

First-Time Home Buyers

Step-by-step guidance for those entering the property market for the first time, including education on down payments, government incentives, and budgeting.

Self-Employed Mortgages

Flexible solutions for entrepreneurs and freelancers with non-traditional income streams.

Refinancing

Unlock better rates, consolidate debt, or access home equity to fund renovations or investments.

Equity Take-Out

Tap into your home’s equity for major expenses or new investment opportunities.

Low Credit Score Solutions

Specialized programs for clients with less-than-perfect credit, improving access to homeownership.

Urgent Closings

Fast-tracked mortgage solutions for clients needing to close quickly.

Equity Lending Mortgages

Alternative lending options for unique financial situations.

Commercial Mortgage Services

Restaurants & Pubs

Financing solutions for hospitality entrepreneurs.

Medical & Dental Offices

Tailored mortgages for healthcare professionals establishing or expanding their practice.

Plaza & Office Buildings

Funding for commercial real estate investments.

Hotels & Motels

Specialized lending for hospitality property acquisition or renovation.

Industrial Properties

Financing for warehouses, manufacturing, and logistics facilities.

Franchises

Support for franchisees seeking to expand their business footprint.

Multi-Family Dwellings

Expertise in financing apartment buildings and other multi-unit residential investments.

Residential Mortgage Services

First-Time Home Buyers

Step-by-step guidance for those entering the property market for the first time, including education on down payments, government incentives, and budgeting.

Self-Employed Mortgages

Flexible solutions for entrepreneurs and freelancers with non-traditional income streams.

Refinancing

Unlock better rates, consolidate debt, or access home equity to fund renovations or investments.

Equity Take-Out

Tap into your home’s equity for major expenses or new investment opportunities.

Low Credit Score Solutions

Specialized programs for clients with less-than-perfect credit, improving access to homeownership.

Urgent Closings

Fast-tracked mortgage solutions for clients needing to close quickly.

Equity Lending Mortgages

Alternative lending options for unique financial situations.

Commercial Mortgage Services

Restaurants & Pubs

Financing solutions for hospitality entrepreneurs.

Medical & Dental Offices

Tailored mortgages for healthcare professionals establishing or expanding their practice.

Plaza & Office Buildings

Funding for commercial real estate investments.

Hotels & Motels

Specialized lending for hospitality property acquisition or renovation.

Industrial Properties

Financing for warehouses, manufacturing, and logistics facilities.

Franchises

Support for franchisees seeking to expand their business footprint.

Multi-Family Dwellings

Expertise in financing apartment buildings and other multi-unit residential investments.

*OAC. Some conditions may apply.

Mortgage calculator

Take the guesswork out of your next move. Use our simple mortgage calculator to estimate your monthly payments and see what you can afford.

Ready to Get Qualified for Your Mortgage?

Book your free discovery call with Kevin today!

Real Estate Investment

Kevin Hoang offers a strategic pathway for young professionals to build wealth through property ownership. Kevin specializes in guiding clients towards affordable investment opportunities in affordable markets, making real estate accessible even in challenging economic conditions. His approach combines market analysis, focus on emerging markets, and long-term wealth building strategies.

Kevin provides comprehensive support throughout the investment process, from property selection to financing. He emphasizes education, empowering clients with market insights and risk mitigation strategies. By partnering with Kevin, young investors gain access to his expertise as both a mortgage agent and real estate investor, positioning them for success in building a profitable property portfolio. This approach serves as a stepping stone for future homeownership or financial independence through real estate.

Discover the potential of investing in ONTARIO

Sudbury

Chatham

Windsor

Sarnia

Niagara

North Bay

Why Consider Alternative Markets?

Secondary and tertiary towns open the door for first-time buyers and investors with its lower purchase prices.

More affordable entry points

Higher ability to cash flow monthly

Diverse rental markets

Risk management

Stepping stone to GTA investments

More affordable entry points

Higher ability to cash flow monthly

Stepping stone to GTA investments

Diverse rental markets

Risk management

What Our Customers Are Saying

Kevin’s guidance was invaluable in helping me secure my first investment property. His knowledge of the Ontario market and mortgage solutions made the process seamless

— Emily R., First-Time Investor

I was impressed by Kevin’s ability to navigate complex financial situations and find the best mortgage options for my needs. His expertise in real estate investment has been a game-changer.

— Rachel T., Homeowner

Kevin’s approach to real estate investment is both strategic and accessible. He helped me understand the potential of small-town Ontario and how it can be a stepping stone to larger investments.

— David L., Young Investor

Ready to Schedule a Discovery Call?

Book your free discovery call with Kevin today!